'Fraught'. 'Frenzied'. 'Suffering'. 'Undefined'.

These are the kind of responses received when we asked our community the first word that comes to mind when describing a compensation review.

From determining an unbiased approach to salary raises, to aligning the conflicting opinions of a myriad of stakeholders, to communicating compensation adjustments to hopeful employees, salary review season can be a tough time of year for People Leaders.

Whether implementing the process for the first time or a seasoned veteran seeking insight on how peers handle the key complexities, this end-to-end guide will help make the next pay review a little less painful and a little more streamlined.

Subscribe to our newsletter for monthly insights from Ravio's compensation dataset and network of Rewards experts 📩

What is a compensation review?

A compensation review (also known as a pay review, salary review, compensation evaluation, merit cycle) is a formal evaluation of employee compensation packages.

Regular compensation reviews ensure that compensation remains fair and competitive compared to the market, keeping engagement high and avoiding any regrettable attrition. It can also be an opportunity to reward high performance (hence 'merit' cycle) and recognise employee career progression with promotions.

Some companies focus on base salary adjustments during the compensation review, whereas others may include other elements like, for instance, a performance bonus or an equity refresh grant – depending on the overarching compensation philosophy and approach.

How to run a compensation review process: a step-by-step guide

Pay reviews are typically a complex process, with many steps, that can take months to complete end-to-end.

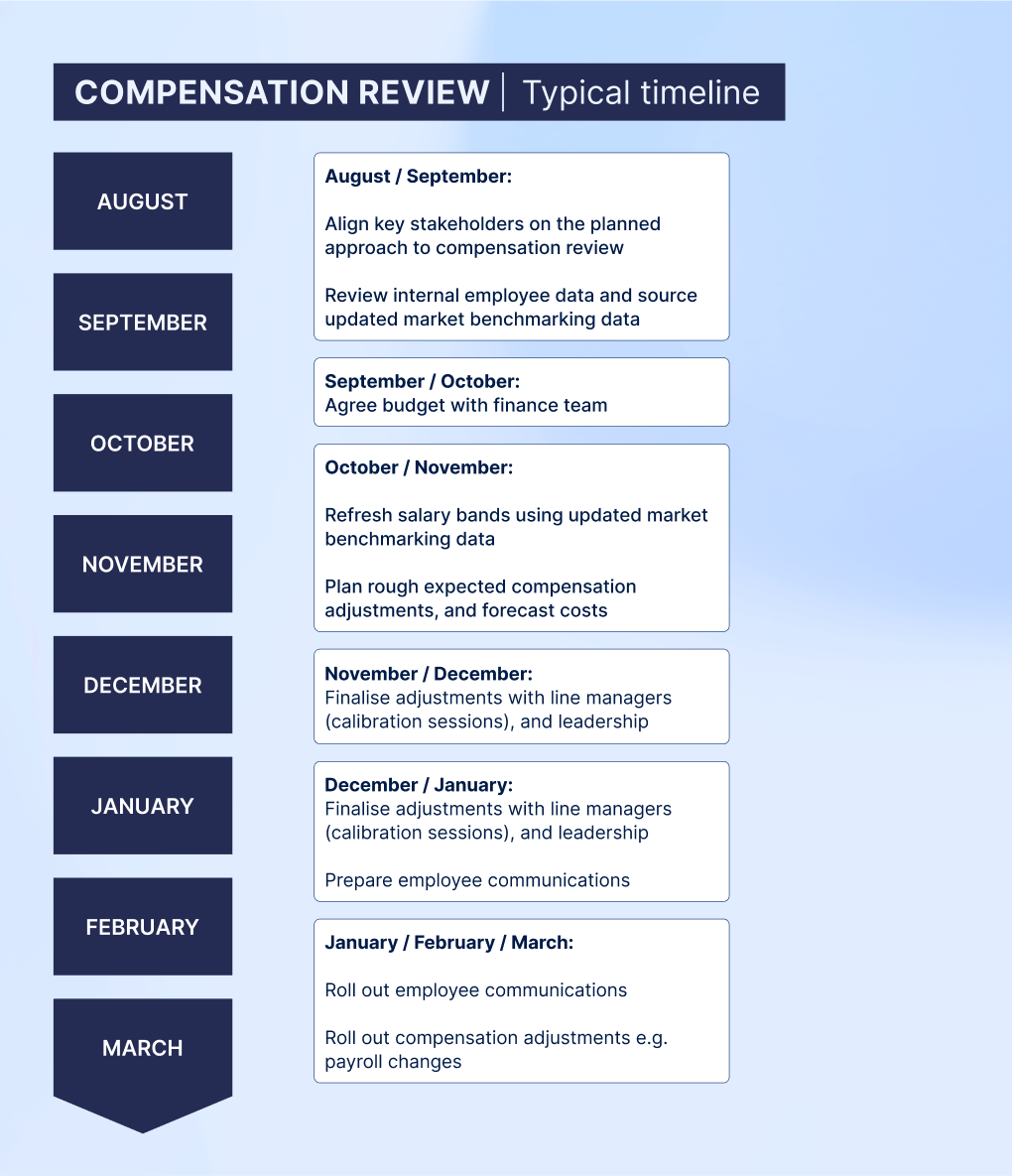

The most typical approach is for a large-scale annual compensation review to take place between August (when project kick-off and stakeholder alignment on the approach takes place) and March (when compensation adjustments are rolled out into payroll).

Here's a detailed breakdown of the key steps involved in running a successful salary review.

Step 1: Leadership alignment on the approach to pay reviews

There are lots of stakeholders involved in the compensation review process, so this theme of alignment, clarity, and communication will come up a lot.

In terms of leadership alignment, it’s important to agree with your leadership team on the core approach to reviewing compensation at your company – ensuring the plan aligns with the overarching business strategy, goals, and culture.

This typically involves the executive team (CEO, COO, CFO) as well as departmental leads who own goals for each core team.

According to Ravio's pay review research, most HR and Reward teams find this stakeholder alignment piece to be one of the most stressful parts of running a compensation review – and it’s important to get that alignment before the process kicks off, to avoid issues later down the line.

“I remember one particularly painful time running a company’s pay review for the first time. I agreed the approach in a kick-off meeting, documented it, and circulated it to stakeholders for review. With no comments added, I pressed on. A few days before rollout, I got a panicked message from the CEO who hadn’t realised work had started and wanted to make changes to the approach. My team had to start the process from scratch, all because I didn't press for confirmation on sign-off.”

Chief People Officer at Ravio

So how do you approach that leadership alignment?

- Work with key stakeholders to understand their business goals and priorities for the upcoming year, and discuss how that relates to talent planning and employee engagement. Our compensation review research found that for most companies the priority outcome for pay reviews is either driving performance or enhancing employee engagement.

- Revisit your compensation philosophy for clarity on the fundamental principles that define how compensation decisions are made at the company – this should help to define factors like how often compensation should be reviewed, whether employee performance should be included in the review process, how market competitive the company aims to be with compensation, and so on.

- Create a central document which outlines the approach, timeline, decision-making process, responsibilities (including ownership between the People Team and line managers), and key objectives of the compensation review. If it's your first compensation review, start with simple foundations, and aim to build on that over time – you don't need a complex process as a small team.

- Schedule time with each key stakeholder to run them through the refined plan, and then make sure you get written sign-off before kicking off the review process.

"Structure is crucial, but it's also important that the structure allows for flexibility, because the reality is that people don't always fit neatly into boxes. This is also especially true for fast growing start ups, where the process you put in place today might need to be completely adapted in 12 months time."

People Partner at People Collective

💡 Key decisions to make when agreeing how your company will approach salary reviews:

- How often will we review employee compensation? Is an annual compensation review enough, or do you need more regular touchpoints throughout the year to ensure pay remains competitive and employees feel their contributions are recognised?

- When should our compensation reviews take place? Is there a certain time of year that makes sense in relation to budgets or hiring plans?

- How should market competitiveness factor into compensation reviews?

- How should employee performance and progression factor into compensation reviews?

- How should internal pay equity factor into compensation reviews?

- How do we handle promotions and level changes?

- What's our stance on manager discretion vs. centralised control? Some companies allow manager overrides within certain parameters, while others maintain stricter central control.

- Do line managers need education or training on any aspect of the process?

Step 2: Agree the pay review budget with Finance

Getting the budget right is crucial, because it defines the pool available to make salary increases and promotions each year.

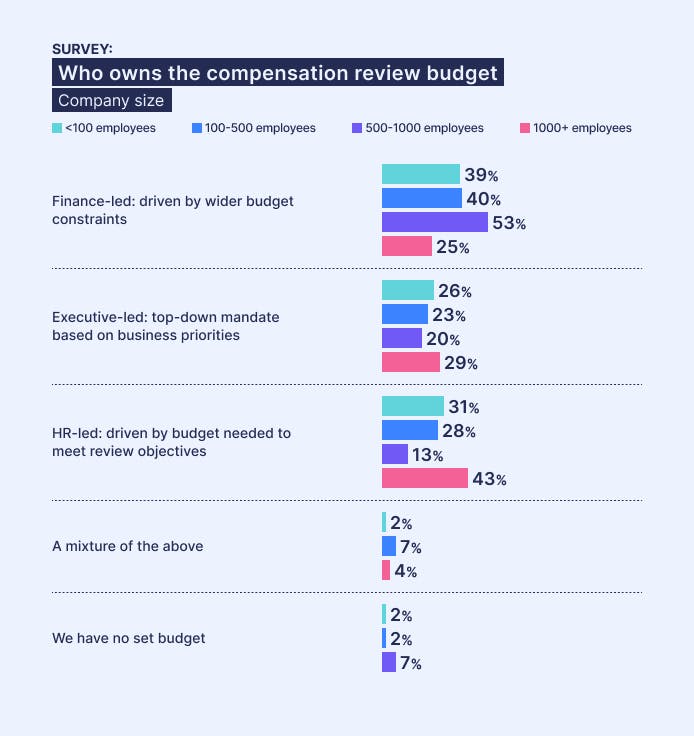

The pay review budget is typically calculated as a percentage of total payroll costs, and there are two common approaches to determining the budget:

- Executive-led: The leadership team issues a top-down mandate for the budget pool for pay reviews, based on business priorities.

- Finance-led. A set budget for the salary review is defined by the Finance team based on overall business costs and budget available. This is then handed to the People Team to decide how to best use the set budget to meet goals.

- HR-led / bottom-up. The HR team calculates the budget needed to meet all compensation review objectives e.g. ensure all employees are in-line with market competitive pay, meaningfully reward the top 10% of performers, promote 5% of the employee base to a new level. This is then taken to the executive team and Finance team for budget approval.

Our research on how companies typically approach compensation reviews found a lot of variance. The most common approach overall is a finance-led budget – but this is less common for companies with 1000+ employees, where an HR-led approach becomes the norm.

This chimes with advice from Lucia Nikolaou that the best approach for most companies is to build a collaborative budget process between HR and Finance teams – to combine the overarching view of budgets with the close understanding of employee needs.

“A hybrid model where Finance and HR collaborate on the compensation review budget represents the most realistic and scalable path for most companies. But, it does require work to establish strong relationships between the two functions, including ongoing communication and shared processes.”

People Leader and HR Consultant at CompanionHub

Step 3: Update benchmarks and refresh salary bands

If market competitiveness is an important element of compensation for your company, then sourcing up-to-date compensation data before you kick-off the compensation review is a must, to determine whether employee compensation is still in-line with the market.

The best practice approach is to refresh your salary bands using the latest market benchmarking data, so that the band position of your employees will tell you how far off your target percentile employees now are compared to the real-time talent market – and this can then be fixed during the pay review.

"Leveraging tools like Ravio for reliable compensation benchmarking data gives you up-to-date information on what competitive pay looks like for companies like you and employees like yours. When it comes to compensation review time, this means you’re able to determine pay increases in a formulaic way to minimise bias."

Compensation Consultant and Founder of Justly

Step 4: Plan compensation adjustments

Once the budget and market data are in hand, it’s time to get into the details and determine which compensation adjustments need to be made.

Different companies approach this in different ways (depending on the approach agreed in step 1!) but the determining factors include:

- Promotions: employees who are ready to progress to the next level of their role should move into the next salary and receive a promotion-based pay increase to reflect this.

- Performance-based increases: for companies that use a pay for performance model, performance ratings will factor into the salary increases that need to be made – so the performance review process and calibration sessions will need to take place first in order to inform the compensation adjustments needed. A performance-focused pay review is typically known as a merit cycle.

- Market-based increases: the refreshed benchmarking data and bands will show where employee compensation might be falling behind the market, and where they may need a pay increase to bring them back to a competitive position. Many companies will use the compa ratio to assess how an employee’s salary compares to market position – with a merit matrix often used to combine this with the performance ratings input.

- Inflation increases: some companies give an across-the-board inflation increase to all employees to reflect changes in inflation rate or cost of living.

Whilst the performance-based and market-based adjustments are broadly consistent across company sizes, it’s much more likely for large companies to include additional factors like salary band outliers and pay equity fixes within the pay review too – reflecting the complexity and maturity of the Rewards function as companies scale.

"Performance reviews and compensation reviews typically go hand-in-hand, with companies rewarding high-performers in some way. There has to be a logical approach to measuring employee performance which uses clear metrics to ensure fairness, and the translation from performance rating to pay increase also needs to be done in a logical and structured way, using a method like a merit matrix to ensure consistency across the entire organisation."

Compensation Consultant and Founder of Justly

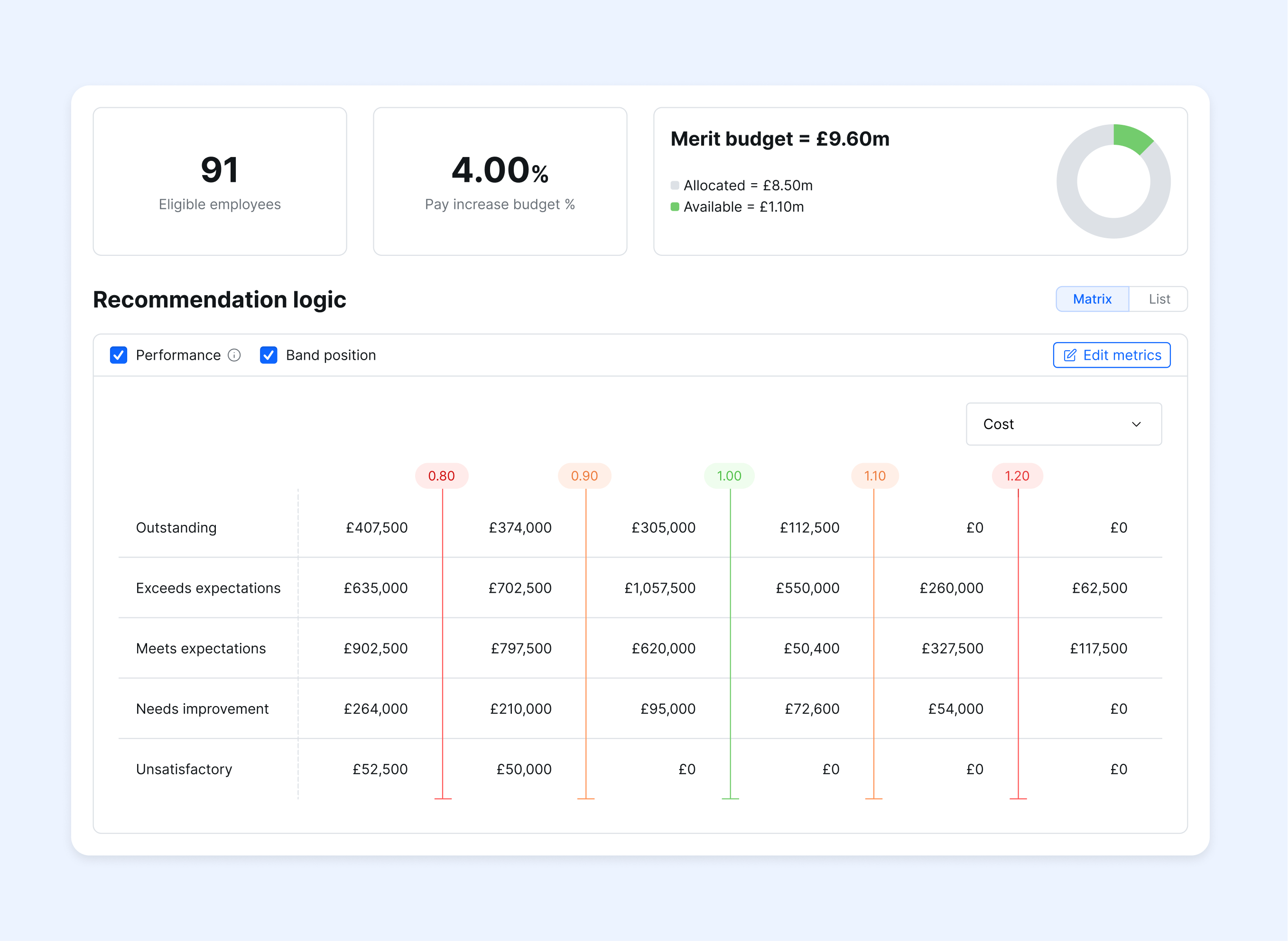

Once you’ve decided which factors to include in your compensation adjustments, you’ll need to go through a scenario modelling process to understand how the budget can be allocated across all of these areas – are we able to offer a 10% increase for the highest performance rating, for instance, or is 8% more realistic?

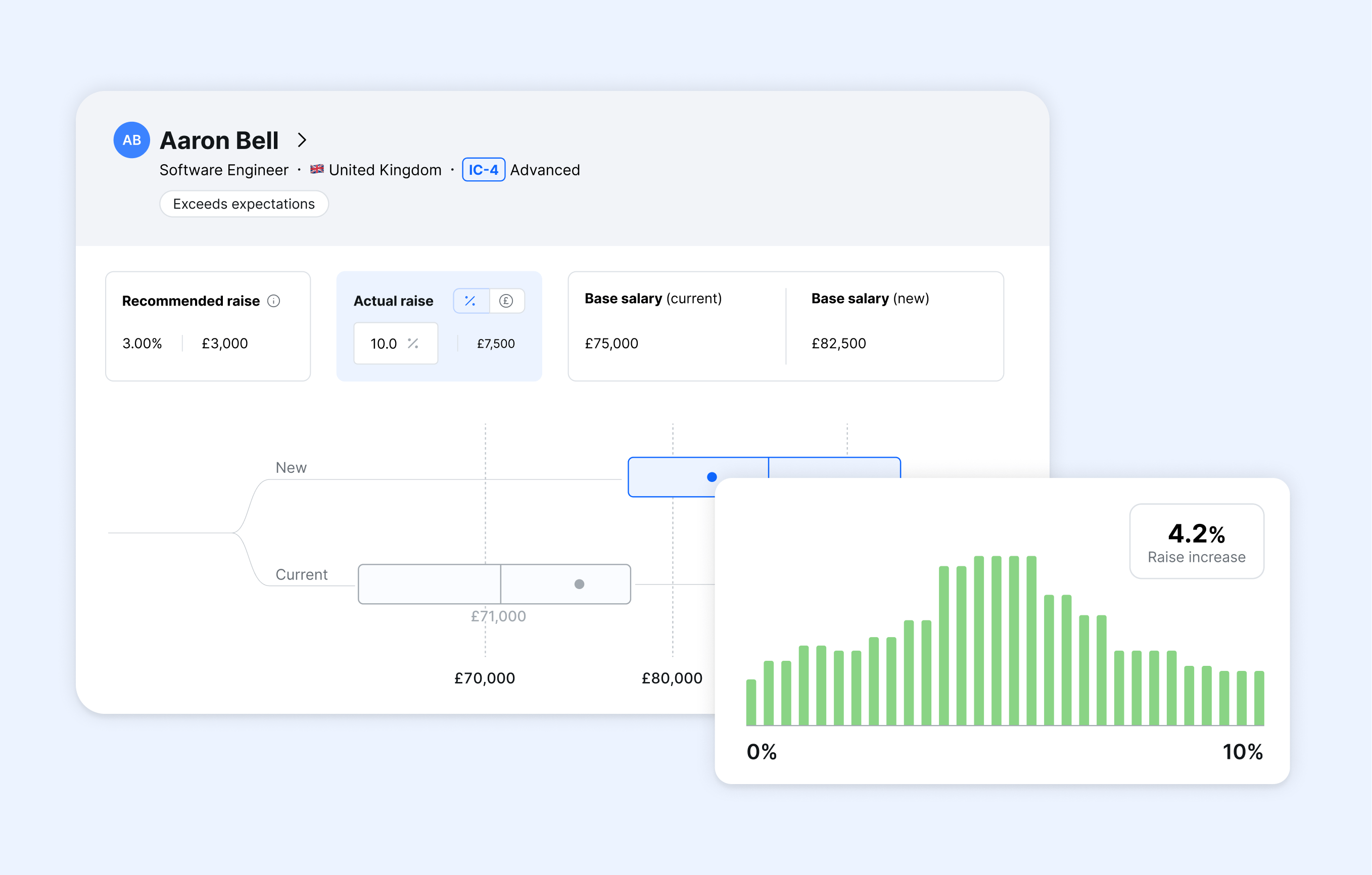

Compensation review tools like Ravio can help you to define the recommendation logic and build any guidelines and guardrails into the process to ensure compliance and budget alignment.

Step 5: Agree compensation adjustments with stakeholders

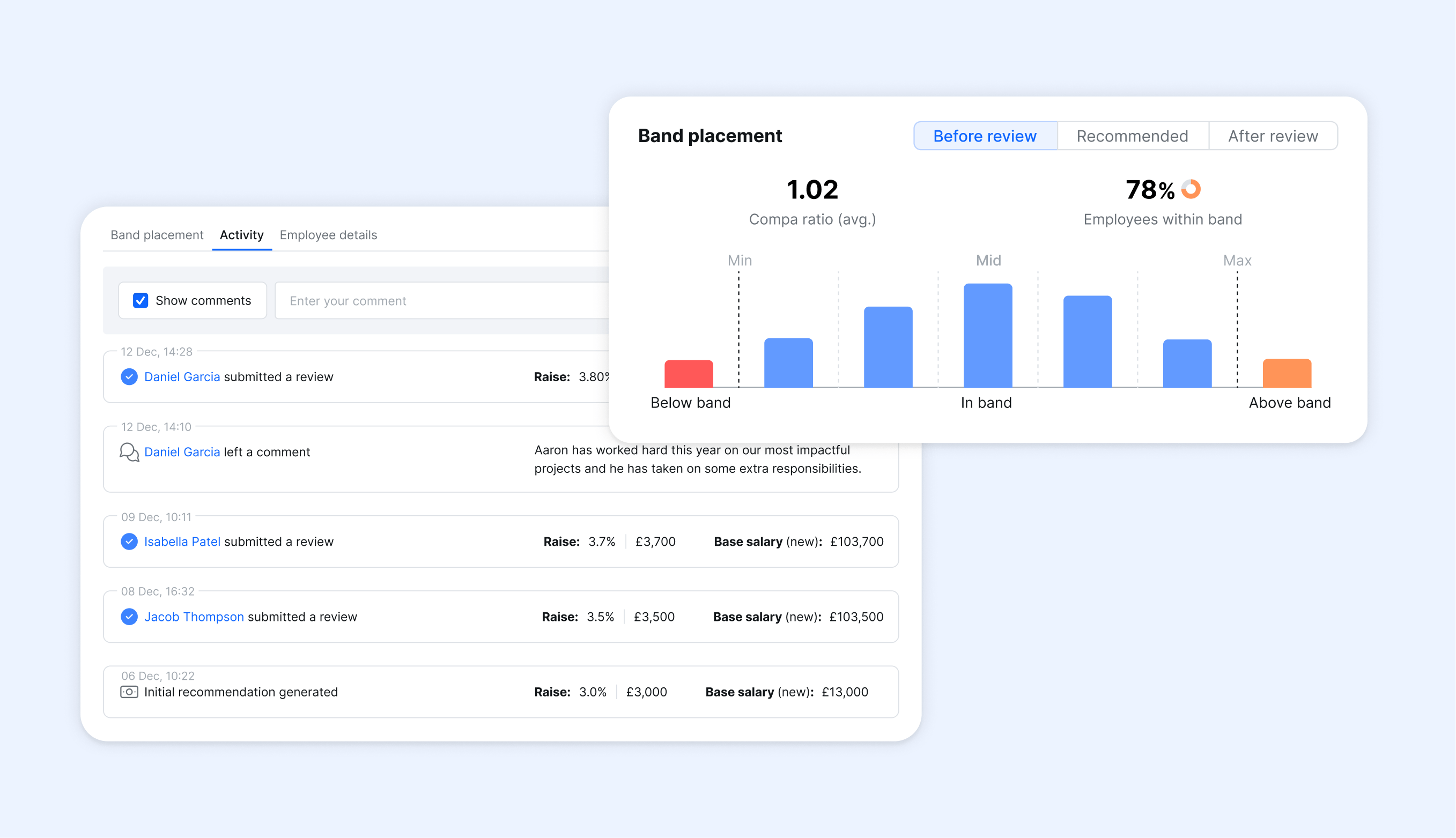

The planned compensation adjustments then need to be reviewed and agreed across all stakeholders.

How this is done will depend on the roles and responsibilities defined in your approach.

For instance, if the People and Reward team have centralised control over the end-to-end process, then the planned adjustments likely only need to be signed off by the leadership team before rollout.

On the other hand, if there’s an element of manager discretion in approving or changing the planned pay increases for their team (which there is in most companies) then a more involved process of manager reviews and approvals will be needed.

Our compensation review research found that the most common approach is collaborative: Reward teams define recommended adjustments, and managers can then suggest changes based on their additional context (41% of companies).

This collaborative approach is particularly popular at larger organisations where 62% of 500-1000 employee companies and 58% of 1000+ companies use this model – and line managers having full ownership over compensation decisions becomes much less likely, likely reflecting the need for more structure to maintain consistency at these larger company sizes.

If manager discretion is included in your approach is the case for your company, it’s important to ensure there are also:

- Clear guidelines and training for managers on how to make compensation review decisions in-line with overall recommendations, and where exceptions are and aren’t acceptable

- Documented responsibilities: defining which parts of the process are owned by the HR team (e.g. initial recommendations for team-wide salary increases) and which are owned by line managers (e.g. final decision on the salary increase per individual)

- Approval tracking to maintain clear records of the discussions around each employee’s salary increase and who approved which adjustments – tools like Ravio automate this, and ensure comment and approval history is always logged and easy to find.

In fact, our research found that where managers have input, 58% of companies require justification for changes and 65% have a final stage of Reward team approval.

Given regulations like the EU Pay Transparency Directive, every company should be enforcing such safeguards to prevent bias creeping into salary review decisions.

Step 6: Communicate compensation adjustments to employees

Once adjustments are signed off and finalised, employees must be informed about any changes to their compensation package.

This is an absolutely crucial part of the process, and one that can be particularly challenging due to the hand-off between People Team and line managers.

In fact, when we asked HR and Reward Leaders how they’d rate their company’s communication with employees about pay reviews for our research report, 68% rated their employee communications as just 1-3 out of 5.

It’s clear the employee communication is a tricky part of the compensation review process, but getting it right contributes to a successful review.

Typically, the People Team will handle company-wide communications about the compensation review process and timeline, but line managers will handle 1-2-1 conversations with employees about the outcome of the compensation review for their specific case.

In terms of company-wide communication about the salary review process, it’s important to include:

- Timeline clarity: Communicate key parts of the process including when feedback will be gathered, when pay changes take effect, when employees will see them in payroll.

- Process transparency: Explain the methodology and criteria used for compensation decisions – always linking back to the company’s wider goals, culture, and compensation philosophy.

- Context setting: Provide market context and budget constraints that influenced decisions.

- Enable two-way dialogue: Pay is inherently personal, so expect lots of questions and clarifications from the team – it can be helpful to communicate via an all-hands meeting, or set up a drop-in session for employees to ask further questions and give feedback on the process.

"When there isn't a clearly-defined approach to the compensation review, it's impossible to communicate the process effectively to employees. And even if there is a clearly-defined approach, it's still too common that communication with employees about the timeline and the reasons behind compensation adjustments is poorly done. This leaves employees with a lack of understanding about how their pay is being reviewed, which ultimately leads to confusion and dissatisfaction."

Compensation Consultant and Founder of Justly

For managers to feel confident communicating compensation outcomes to their team, it’s important to consider:

- Decision rationale: Ensure managers understand the reasoning and rationale behind compensation adjustments.

- Conversation guidance: Provide scripts and talking points for the most common difficult conversations.

- Escalation procedures: Establish clear processes for handling employee concerns or appeals.

- Support resources: Offer coaching or role-playing preparation for managers who are nervous about compensation conversations – especially common for new-in-role managers.

Looking at our pay review research, most companies are sharing the basics of what adjustments are being made – but miss the decision rationale, so there’s a huge opportunity for improvement there.

93% tell employees their compensation adjustment, and 59% also provide rationale for the decision made. Fewer help employees understand their market position (15%), band progression opportunities (13%), or pay equity compared to colleagues (2%) – a significant missed opportunity to build understanding and trust.

"Managers often fail to properly explain the rationale and approach behind compensation adjustments. It's also too common for managers to place blame on the People Team in order to make the conversations less difficult for themselves – saying things like 'well I advocated for you to receive a salary raise, but the decision was made by the People Team and it was out of my hands'."

Chief People Officer at Ravio

Step 7: Update documentation and payroll

The process also involves some logistics: ensuring compensation adjustments are reflected in all documentation, HR systems, and payroll systems.

If you use a compensation management tool like Ravio then any pay changes made during the merit cycle will be automatically reflected in your wider compensation structure, such as updating salary bands to reflect promotions or pay increases.

Step 8: Review the success of the compensation review

Once the pay review is complete, it’s important to reflect and report on how the eventual outcomes align with the initial objectives of the compensation review that were defined way back in step 1.

This will likely include reporting against key metrics like:

- Budget adherence: budget vs actual costs

- Market positioning: target percentile vs actual positioning and remaining outliers

- Pay equity analysis: before and after view of pay equity

It should also include stakeholder feedback. Did the leadership team feel the process reflected business priorities? Did line managers feel their team received fair outcomes? Do employees have clarity on why they received the pay increase they did? Which parts of the process felt stressful?

All of this information helps to ensure you can continue to improve and iterate on the process each time.

Our pay review research found that by far the most common success metric that companies are using is budget adherence (especially common for 500+ employees) – with employee satisfaction feedback, retention rates, and pay equity before and after following quickly behind.

Frequently asked questions

How often should we have salary reviews?

45% of companies run an annual compensation review (Ravio report, 2025), with a further 23% running one per year but with off-cycle adjustments made as needed.

However, 27% of companies now run a bi-annual pay review – finding that more regular reviews are needed to keep compensation fair and competitive for the team.

How long should a pay review take?

Pay reviews can be lengthy processes, typically taking around 5 months end-to-end due to all the factors involved. For instance, if you run a compensation review in Q4, you’ll likely start planning the process with key stakeholders, agreeing the budget, and refreshing salary benchmarking data in Q3 – and the salary adjustments made will likely be rolled out to employee payslips in Q1.

Do I need a compensation review tool?

Whilst small companies might manage with spreadsheets for running salary reviews, companies typically need dedicated compensation review software once they reach 500+ employees.

Compensation review tools like Ravio help teams to:

- Streamline compensation review processes

- Avoid human errors – especially when multiple people (e.g. HR team and line managers) are inputting information into large spreadsheets

- Enable manager input and approvals – with tracked comments and approval history in-platform.

- Stay on top of budget, salary band, and pay equity impacts throughout the process

What is the average salary increase during a pay review?

The average salary increase is typically 3-5%. In 2024, for instance, the average salary increase across European tech was 5.0% (Ravio data)

The actual salary increase each employee receives will depend on factors like their performance rating, salary band position, pay equity compared to their colleagues, and more.

What is a merit cycle?

A merit cycle is a compensation review process that includes performance as a key factor in how employee salaries are adjusted, as part of a pay for performance model.

In a merit cycle, employee performance will be evaluated first, and the resulting performance ratings are used as an input to determine compensation adjustments (which could be pay increases or other levers such as equity refreshers or performance bonuses), with the aim of meaningfully rewarding high performing employees in order to retain them.

How do I justify a salary increase that's below inflation?

Transparent communication is key. Share the budget constraints, explain how performance and market data factored into decisions, and acknowledge economic pressures while reaffirming your commitment to fair pay.

Showing the data behind the decision can help too – tools like Ravio make it possible to show employees the salary benchmarks that were used to make decisions, and how their salary compares to the market in reality, outside of just inflation as a factor.

What's the difference between a salary review and a salary increase?

A salary review is the structured process of evaluating employee salaries across the organisation, whereas a salary increase is an individual outcome. Not all salary reviews result in a salary increase for an individual employee – but every salary increase should result from a fair, structured salary review process.

How do I handle employee disappointment with their performance rating or pay increase?

Coach managers to have empathetic, transparent conversations and provide employees with actionable feedback and development goals.

Having clear rationale and process transparency helps mitigate negative reactions, ensuring that managers are well-equipped to explain the 'why' behind decisions using data and clear frameworks.

Should compensation reviews be tied to employee performance?

86% of companies do tie compensation reviews to employee performance (Ravio report, 2025) – and this is broadly consistent across company sizes, though slightly more likely for large enterprises of 1000+ employees.

The most common approach is to factor performance rating into base salary increases – but with legislation like the EU Pay Transparency Directive incoming, some teams are questioning whether this is a fair and consistent approach to take.

Alternative approaches include rewarding performance through one-off bonuses, equity refreshers, accelerated promotion pathways, or benefits such as additional flexible working abilities.

Should compensation reviews include an annual across-the-board inflation raise?

The economy has been shaky (to say the least!) in recent years, which has led to much discussion around whether compensation reviews should include an across-the-board inflationary raise.

Inflation brings with it increased cost of living for employees, and a pay raise in line with inflation ensures that employees are no worse off year on year.

However, inflation also brings with it an increased desire for job security, meaning that churn is lower as employees are less willing to change roles and there is less need to incentivise retention through compensation increases. Plus, there’s also the question of what happens when the economy is strong and in negative inflation – companies can’t roll back the inflationary raise at this point.

Ultimately, the decision of whether to give inflationary raises is personal to your company, and is a principle to be agreed as part of the overarching compensation philosophy and approach.

Can we run compensation reviews without performance reviews?

Yes, some companies decouple the two – the compensation review focuses on factors like inflation and maintaining alignment with market data, whilst the performance review focuses on employee feedback and progression.

The performance review can be a stressful time for employees when it feels like income is on the line, so decoupling the two can help to bring clarity on the factors that go into pay decisions.

Some companies will also have a salary review model that includes both market adjustments and performance recognition, but through separate mechanisms – for instance, market adjustments might impact base salary increases, but performance is recognised via equity refresh grants or a one-off performance bonus.

How can you prepare for a compensation review process?

Given the amount of moving parts and stakeholders involved in a compensation review, getting prepared well in advance of kick off is key.

Here’s a few tips to get prepared:

- Remind the team of your compensation philosophy, so that the core principles behind compensation decisions are front of mind.

- Agree the approach with all key stakeholders, to ensure alignment on decisions such as whether performance will be included in pay adjustments or the priority ranking between market adjustments and pay equity fixes.

- Refresh your salary benchmarking data to ensure an accurate and up-to-date view of competitive compensation – use a real-time tool like Ravio for reliable, relevant data.

- Set and communicate timelines to all involved – including leadership, line managers, and employees too.